Data Analytics, Insights & Applications

Data Analytics, Insights & Applications Marine insurers and reinsurers have a growing need to better monitor and assess risk accumulations. Skytek currently operates the REACT platform. This software offers a service that provides estimates of marine hull risk accumulations based on vessel traffic information provided by S-AIS/AIS technologies.

These days processing power is growing, image analysis and object detection techniques are rapidly improving, high-resolution satellite data and aerial imagery availability and coverage are also increasing. That is why it has become feasible to provide improved data intelligence for marine insurance and reinsurance organisations that are based on Earth Observation (EO) data.

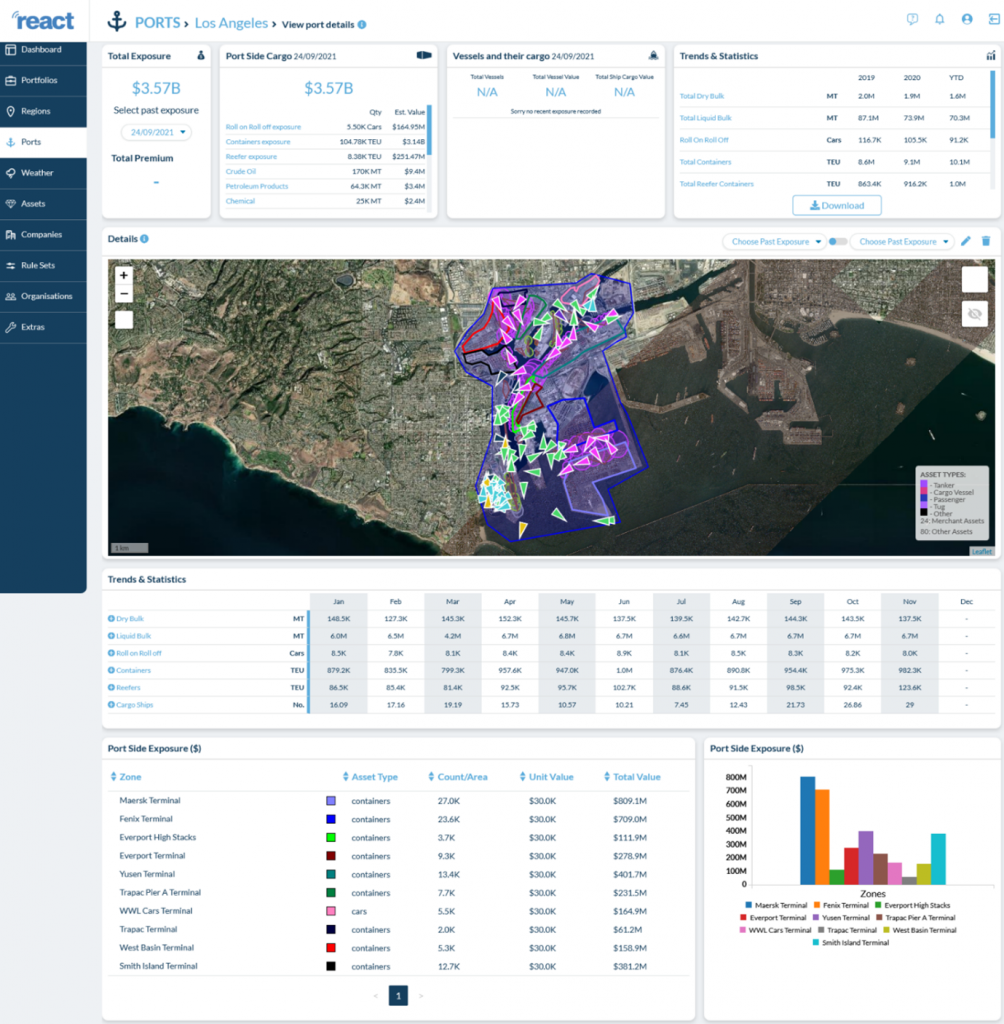

The activity extended the existing risk picture by using satellite data and modern image analysis combined with machine learning techniques. The result supports analysis of risk accumulation of cargo within ports which can range from both containers stored portside, through to car storage terminals combined with cargo on board vessels currently docked at ports worldwide. The solution supports seamless tasking of high resolution commercial EO satellites combined with open sources such as Sentinel 2 to provide the underlying images which are then analysed to extract intelligence regarding cargo accumulation which is then made available to end users as an ongoing service.

This product targets insurance, reinsurance and brokers organisations that deal with marine insurance. To support the marketing and distribution of this product, Skytek has signed a partnership with Aon, one of the biggest global insurers.

Through Aon a new consultancy service based on the Skytek’s REACT system expanded with the capabilities of this CPA project. This service now allows insurers and reinsurers to visualise the precise location of their insured risks alongside crucial vessel and cargo accumulation and risk information. Aon’s experts work closely with the insurers and reinsurers to analyse the potential accumulations and make specific recommendations to their portfolio for efficient reinsurance programmes and underwriting insights.

One of the primary concerns for the marine insurance industry is monitoring the risk accumulations in ports. Ports steadily increasing their throughput and growing cargo vessel capacities have a big impact on risk accumulation. The increasing risk of climate/weather induced catastrophic events also compounds this problem.

Through their global networks of clients, Aon’s is actively promoting and introducing the concept and platform of the Cargo Port Analysis using EO and GNSS.

The product targets insurance and reinsurance companies globally. Using this platform is now more important The product targets insurance and reinsurance companies globally. Using this platform is now more important than ever for the insurance industry, with an ever-increasing throughput of cargo and containers in ports worldwide as well as an increased severity of storms and weather patterns due to climate change. Providing a near real time insight into cargo exposures and risks at major ports worldwide, on an ongoing basis and post catastrophe, allows for insurance organisations to better plan and quickly understand potential liabilities.

The system provides a web accessible and external API cloud-based SAAS platform. Information on potential port or fleet liability can be provided in near real time based upon past vessel history, vessels attending a specific port terminal, their expected cargo loads, and quantity as well as value combined with on-port cargo value analytics. This functionality is achieved through data-fusion of multiple data sources into common unified models, to create a large set of mineable geo-spatial data presented in a user-friendly multi-aspect html interface.

The new CPA component, deployed as a new component within the REACT platform uses a combination of the latest Artificial Intelligence, Machine Learning, EO, GNSS technology and big data analytics techniques are used to provide a cargo port analysis solution directly relevant to marine insurance and reinsurance organisations. The system integrates tasking of satellites, to take frequent high-resolution imagery, at over 200 major ports locations worldwide in which the majority of cargo worldwide passes through.

The insurance companies base their decisions on models, known as Catastrophe or CAT models, which are currently provided by a few specialist companies. None of these models and modelling software currently use satellite EO data as a source of information. The models are very high level in nature and usually provide a large margin of error in the risk exposure calculations for cargo within a port.

By using EO and GNSS, the Cargo Port Analysis brings added value by providing a far more accurate risk exposure picture. Instead of using a generalised CAT model, the real status of a port is analysed on current levels of cargo both onshore and in docked vessels. Cargo can range from standard containers, through to reefers (refrigerated containers) and vehicles stored port side. The underlying information allowing for this analysis to be performed is sourced using EO satellite and aerial imagery, and using automatic image analysis and information extraction. This approach leads to a fully automated risk exposure calculation solution which can be used for the major cargo ports worldwide.

The amount of available high-resolution satellite and aerial imagery is growing, and the global coverage is constantly improving which further enhances the CPA solution in terms of quality and temporal availability. This creates a stable competitive advantage that is grounded in Skytek’s high level of competency and experience in processing and analysing satellite imagery.

The activity kicked off in June 2019 and was planned in two major phases: the rapid prototyping phase aiming to frontload research and proof of concept work, in particular in relation to application of ML/DL to EO images and confirm to the project stakeholders the capability of envisioned technology and secondly the integration phase with the goal of delivering production grade software and integrating the solution in the wider context of the REACT platform.

The prototype of technical solution was successfully delivered at Critical Design Review milestone in October 2020. The integration phase then followed, and the product was successfully integrated with the existing platform and brought to production level at the Commercial Acceptance Review milestone in May 2021. The product was successfully trialled and demonstrated to a range of end user clients within both the insurance, reinsurance and broker industries and the final presentation was successfully held in December 2021.

Throughout the whole project Skytek led an intense marketing campaign with the support of the major insurance industrial partner Aon. The REACT platform was presented to many insurance and reinsurance companies in Europe, USA and Japan and generated substantial interest and engagement followed by initial sales. The intense marketing campaign of the REACT platform with the Incubed CPA solution provided for the establishment of a strong presence in insurance industry. The newly developed concept had a big role in grabbing the attention of the insurance companies as something that hasn’t been done before and that could be a source of competitive advantage through better risk modelling and improved claims processing. During the time of the project Skytek managed to sign first sales contracts for the system. The marketing campaign continues in 2022 with future sales agreements outlook positive.