Data Processing & Visualisation

Data Processing & Visualisation  Data Analytics, Insights & Applications

Data Analytics, Insights & Applications Currently, many farmers are unable to access credits to buy inputs such as seed and fertilisers. Women and young people are particularly disadvantaged. With the agriKOPA service, agriBORA creates a credit score which provides more objective access to loans.

Working together with our agriHUBs, agriBORA already provides farmers with inputs, as well as linkage to the markets through contracts with agri-processors. We provide farmers with advice throughout the season, based largely on satellite EO data. But access to credit is generally acknowledged to be a major problem for farmers, negatively affecting their ability to make a living.

Since agriBORA’s major revenue stream comes from commission charged on transactions which take place over our platform, farmers’ lack of access to credit is also a problem for agriBORA.

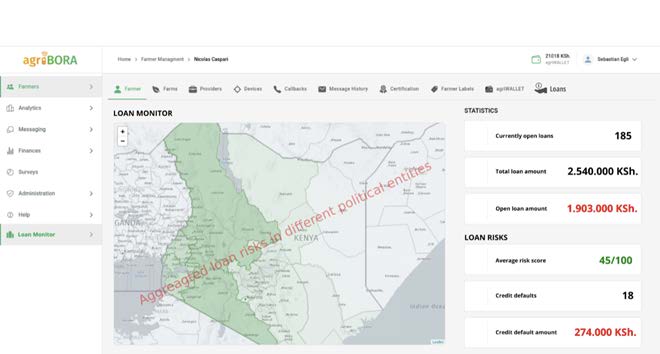

The agriKOPA product produces a credit-score which enables Financial Service Providers to lend with confidence. In addition, during the growing season, EO-based yield forecasts help the lenders to constantly monitor their risk.

We have three main customer groups for our product: smallholder farmers, agriHUBs and Financial Service Providers (FSPs).

Smallholder farmers often lack money for high quality seeds and fertilizers and also for services like ploughing and soil-testing. With our concept of earmarked loans we provide farmers with financial resources exactly when they need it.

For agriHUBs and their managers, enabling loans means that the farmers have more money to spend on the products and services provided by the hubs. The agriKOPA service helps the agriHUBs retain their customers and build sustainable businesses.

FSPs see the smallholder farmer sector as risky and inefficient to service. Obtaining the basic data before even considering a loan is difficult and costly. Estimating the creditworthiness is a problem, with women particularly disdvantaged. The FSPs also need information on the development of the harvests in regions where they have granted loans in order to monitor their risks.

The picture below shows an agriBORA “agriHUB”, being visited in connection with the requirements definition phase of the project.

The agriKOPA product will be first introduced in a number of counties in Western Kenya. Thereafter, the product will be made available throughout Kenya, with expansion into other African countries also in the planning.

The agriKOPA product is innovative in many respects. The application of earth observation data and the compilation of immutable transaction histories using information stored in our agriLEDGER is ground-breaking in the agricultural sector in Kenya. With earth observation data, we monitor the crop development and can give timely insights to banks and farmers regarding problems arising. The farmer interacts with our software-as-a-service platform through his phone through a USSD-code menu, removing the need for a smartphone. With the banks, the interaction will be through an API interface connecting our software to the software of the bank. The diagram below shows the service to allow FSPs to monitor their risks.

Our main competitors provide farming inputs and services at different types of farmer service centres. They provide credit facilities, often linked to insurance policies. The credits are financed directly by the company or in cooperation with banks.

We bring added value through our innovative credit scoring algorithm and field monitoring which is enabled by earth observation, machine learning and artificial intelligence. AgriBORA is the only company which provides a true end-to-end service, ensuring that contracts are in place with agri-processors, thereby providing a guaranteed access to market. This in turn greatly reduces the risk of bad debts for the FSPs.

The agriBORA Kick-Off meeting (KOM) took place online on 25th July 2023 and the Requirements Review was successfully concluded at the beginning of October.

We are now preparing for the Critical Design Review, currently scheduled for the end of November.